Smart paycheck calculator

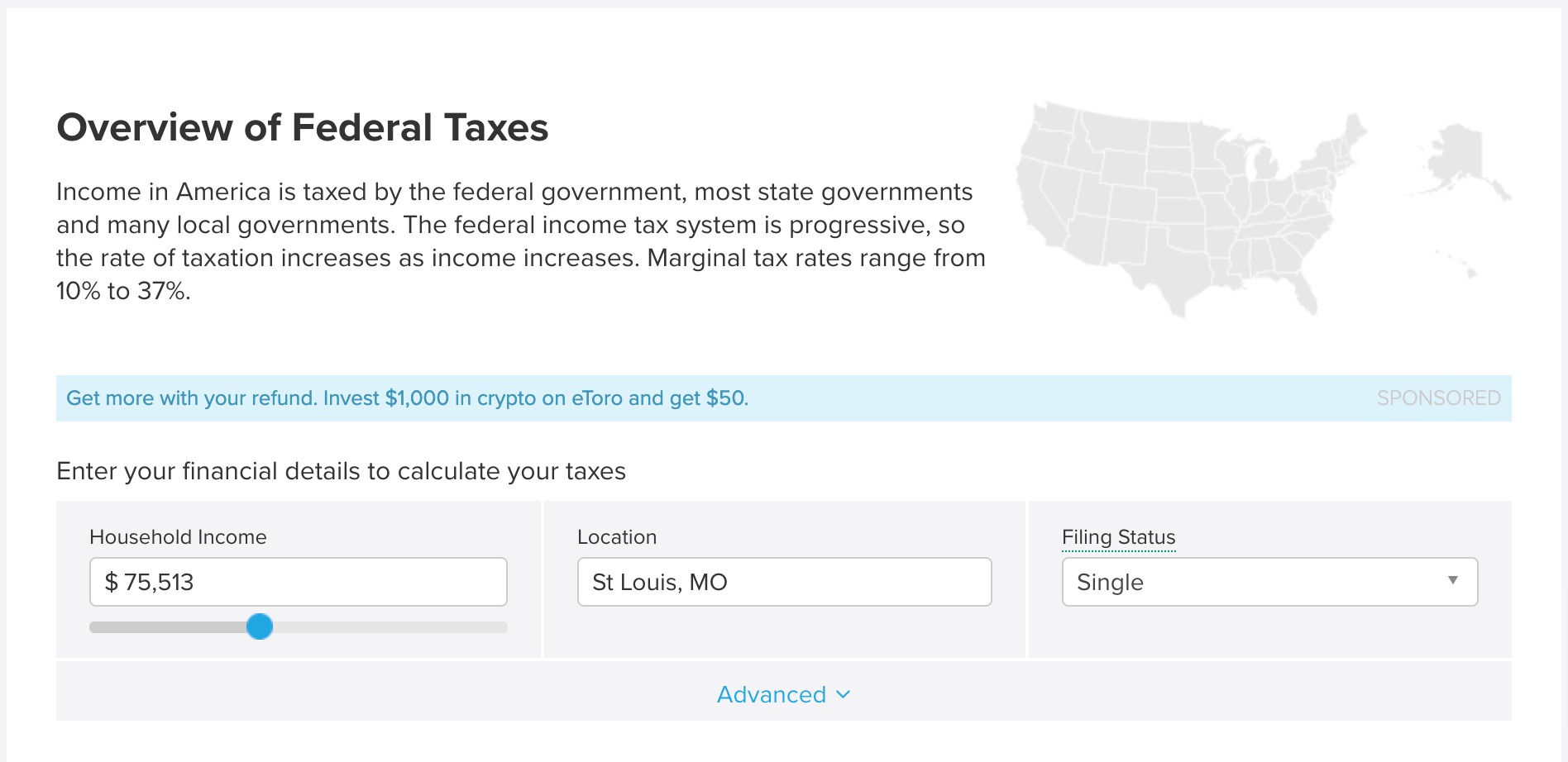

Your household income location filing status and number of personal exemptions. An interest vested in this also an item of real property more generally buildings or housing in general.

Payroll Tax Calculator For Employers Gusto

Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 45.

. We assume you will live to 95. The Minnesota state income tax is based on four tax. West Virginia has a progressive five-bracket state income tax system with rates ranging from 300 to 650.

Overview of Vermont Taxes. Aside from state and federal taxes. Whether youre considering getting started with investing or youre already a seasoned investor an investment calculator can help you figure out how to meet your goals.

Overview of California Taxes. Its a high-tax state in general which affects the paychecks. Utah has a very simple income tax system with just a single flat rate.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. After over 40 years of serving working parents the Working Mother chapter is coming to a close. If youre an on-paper on-purpose type of person when it comes to handling your personal finances download one of our budget forms or other useful spreadsheets.

Overview of West Virginia Taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Overview of Utah Taxes.

Hourly Paycheck and Payroll Calculator. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Overview of Massachusetts Taxes.

A financial advisor in Minnesota can help you understand how these taxes fit into your overall financial goals. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. We stop the analysis there regardless of your spouses age.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. How Your Ohio Paycheck Works. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

In terms of law real is in relation to land property and is different from personal property while estate means. Mortgage lenders use the debt-to-income ratio to evaluate the creditworthiness of borrowers. Overview of Kansas Taxes.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. Need help calculating paychecks.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. All taxpayers in Utah pay a 495 state income tax rate regardless of filing. We automatically distribute your savings optimally among different retirement accounts.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. We are moving in a new direction focusing our efforts more fully on making transformational change within organizations to create equity and inclusion in the workplace for all. Though sales taxes in Louisiana are high the states income tax.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Overview of Colorado Taxes. We assume that the contribution limits for your retirement accounts increase with inflation.

That goes for both earned income wages salary commissions and. Overview of New York Taxes New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Florida residents only.

It can show you how your initial investment frequency of contributions and. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The calculations are even tougher in a state like Ohio where there are state and often local income taxes on top of the federal tax withholding.

Vermont has a progressive state income tax system with four brackets. Income tax rates in Kansas are. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future.

It represents the percentage of your monthly gross income that goes to monthly debt payments including your mortgage student loans car. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. How You Can Affect Your Minnesota Paycheck.

Immovable property of this nature. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Overview of Louisiana Taxes. Louisiana has three state income tax brackets that range from 200 to 600. The states top income tax rate of 875 is one of the highest in the nation.

A financial advisor in Minnesota can help you understand how taxes fit into your overall financial goals. To the millions of you who have been with us. The top rate of 684 is about.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. There are three tax brackets in the Sunflower State with your state income tax rate depending on your income level. Overview of Nebraska Taxes.

Nebraska has a progressive income tax system with four brackets that vary based on income level and filing status. If you want to adjust the size of your paycheck first. It is not a substitute for the advice of an accountant or other tax professional.

Real estate is property consisting of land and the buildings on it along with its natural resources such as crops minerals or water. Calculating your paychecks is tough to do without a paycheck calculator because your employer withholds multiple taxes from your pay. California has the highest top marginal income tax rate in the country.

This top rate is right around. Massachusetts is a flat tax state that charges a tax rate of 500. Your household income location filing status and number of personal exemptions.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees.

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

California Paycheck Calculator Smartasset

Paycheck Calculator Online For Per Pay Period Create W 4

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Smartasset Paycheck Calculator Flash Sales 57 Off Www Ingeniovirtual Com

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator